- Get link

- Other Apps

The idea of cash laundering is essential to be understood for these working within the financial sector. It is a course of by which dirty cash is converted into clear cash. The sources of the cash in precise are felony and the cash is invested in a manner that makes it look like clear cash and hide the identity of the prison part of the money earned.

While executing the monetary transactions and establishing relationship with the brand new clients or sustaining current prospects the duty of adopting enough measures lie on each one who is part of the organization. The identification of such component in the beginning is simple to take care of as a substitute realizing and encountering such situations later on in the transaction stage. The central bank in any nation offers full guides to AML and CFT to combat such activities. These polices when adopted and exercised by banks religiously present sufficient security to the banks to deter such conditions.

For complete classification of this Act to the Code see section 78a of Title 15 and Tables. Government agencies to detect and prevent money laundering.

Bank Secrecy Act Bsa Anti Money Laundering

2 Alpine the defendant was an SEC-registered broker-dealer specializing in clearing and settlement services for penny stocks and micro-cap securities.

Bank secrecy act statute. Bank Secrecy Act BSA enacted. But financial institutions face a dilemma that has not been solved via the courts or academia. A broker or dealer registered with the Securities and Exchange Commission under the Securities Exchange Act of 1934 15 USC 78a et seq.

BANK SECRECY ACT ANTI-MONEY LAUNDERING AND OFFICE OF FOREIGN ASSETS CONTROLSection 81 also be incorporated or organized under US. Title I authorized the Secretary of the Treasury to issue regulations which require insured financial institutions to maintain certain records. A2G is act June 6 1934 ch.

The following is a summary of the most significant changes to the AML legal landscape including. 881 as amended which is classified principally to chapter 2B 78a et seq of Title 15 Commerce and Trade. Alpine had previously been the subject of an.

Enact Money Laundering Control Act. Part 21 minimum security devices and procedures reports of suspicious activities and bank secrecy act compliance program 2111 Ensures that national banks file a Suspicious Activity Report when they detect a known or suspected violation of federal law or a suspicious transaction related to a money laundering activity or a violation. And may only be exempted to the extent of its domestic operations.

A commercial bank or trust company. A broker or dealer in securities or commodities. Laws and be eligible to do business in the US.

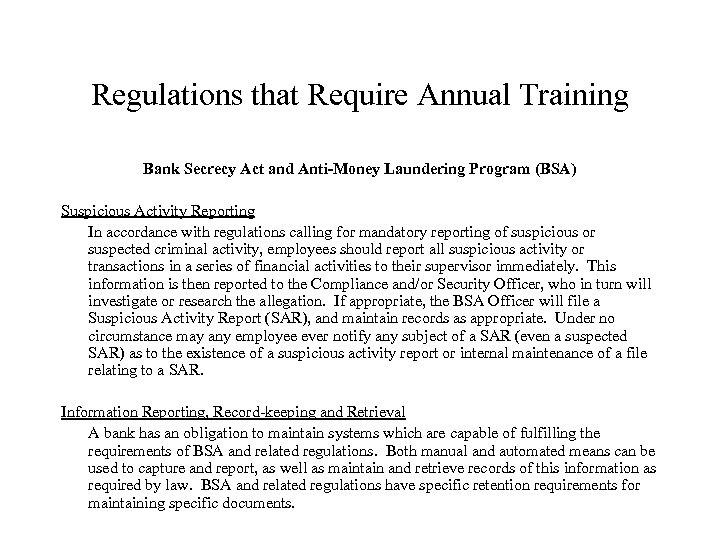

A federal law the Bank Secrecy Act BSA 1 mandates that financial institutions a broad category of businesses offering financial services 2 must collect and retain information about their customers and share that information with the Financial Crimes Enforcement Network FinCEN a bureau within the Department of the Treasury. The Bank Secrecy Act is a United States federal statute enacted in 1970 to detect and prevent money laundering within financial institutions. The Bank Secrecy Act The BSA consists of two parts.

Title I Financial Recordkeeping and Title II Reports of Currency and Foreign Transactions. Some Observations on the Bank Secrecy Act 37 CATH. Do Reporting Requirements Really Assist the Government 44 ALA.

Insufficient intelligence analysis and resources to support financial investigations. The Securities Exchange Act of 1934 referred to in subsec. The Bank Secrecy Act As mentioned in the introduction terms like Bank Secrecy Act or BSA are frequently used in connec - tion with the compliance duties of finan - cial institutions but they do not usually refer to a single statute although as we will discuss there is a federal law called the Bank Secrecy Act.

A whistleblower provision in FIRREA provides its own cause of action. Constitutionality of Bank Secrecy Act questioned. Law Enforcement looks for new weapons to combat drug trafficking.

Supreme Court holds BSA to be constitutional. An Act to provide for the licensing and regulation of the businesses of banks merchant banks and related institutions and the credit card and charge card business of banks merchant banks and other institutions and matters related thereto. One of the core features of the NDAA however is Division F The Anti-Money Laundering Act of 2020 AMLA or the Act which makes sweeping reforms to the Bank Secrecy Act BSA and other anti-money laundering rules.

Rusch Hue and Cry in the Counting-House. This BSA provision mirrors a provision in the Financial Institutions Reform Recovery and Enforcement Act of 1989 FIRREA which forbids banks from terminating or discriminating against employees for providing information to federal agencies about a violation of law by the bank or its employees. An agency or branch of a foreign bank in the United States.

Bank Secrecy Act The Currency and Foreign Transactions Reporting Act of 1970 which legislative framework is commonly referred to as the Bank Secrecy Act or BSA requires US. 3 The emergence of Bitcoin and follow-on decentralized crypto. This IRM provides guidance on special procedures which are unique to Bank Secrecy Act BSA examinations including issuance of a Title 31 summons processing Power of Attorneys and referrals to FinCEN for potential civil monetary penalties.

Byrne The Bank Secrecy Act. Despite the Bank Secrecy Act BSA safe harbor provision filing a SAR does not excuse a financial institution from liability for continuing to transact business with a client. Financial institutions to assist US.

Report SAR reporting as required by the Bank Secrecy Act BSA but under Section 17a and Rule 17a-8 of the Exchange Act. The BSA requires financial institutions to keep.

Bsa Aml Compliance What Is The Bank Secrecy Act

The Bank Secrecy Act Of 1970 What You Need To Know

Bank Secrecy Act 101 Six Things Every Aml Person Needs To Know Acams Today

Bank Secrecy Act Text Finance Laws Com

Bank Name Logo Employee Compliance Orientation Revised

Overview Of Bsa Aml Ofac Regulations And The Regulatory Bodies

Overview Of Bsa Aml Ofac Regulations And The Regulatory Bodies

4 26 14 Disclosure Internal Revenue Service

Overview Of Bsa Aml Ofac Regulations And The Regulatory Bodies

Http Pubdocs Worldbank Org En 566181572546424600 Day 2 David Kim Frbny Aml Pdf

Bank Name Logo Employee Compliance Orientation Revised

Bank Secrecy Act 101 Six Things Every Aml Person Needs To Know Acams Today

Bank Name Logo Employee Compliance Orientation Revised

Bank Name Logo Employee Compliance Orientation Revised

The world of rules can look like a bowl of alphabet soup at occasions. US money laundering regulations aren't any exception. We've compiled an inventory of the highest ten money laundering acronyms and their definitions. TMP Risk is consulting agency centered on defending monetary companies by reducing danger, fraud and losses. Now we have huge bank experience in operational and regulatory danger. We now have a strong background in program administration, regulatory and operational threat in addition to Lean Six Sigma and Enterprise Process Outsourcing.

Thus cash laundering brings many opposed penalties to the group because of the dangers it presents. It increases the chance of major risks and the opportunity cost of the financial institution and ultimately causes the financial institution to face losses.

Comments

Post a Comment